Portal:Economics

Portal maintenance status: (December 2018)

|

Introduction

Economics (/ˌɛkəˈnɒmɪks, ˌiːkə-/) is a behavioral science that studies the production, distribution, and consumption of goods and services.

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyses what is viewed as basic elements within economies, including individual agents and markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and investment expenditure interact; and the factors of production affecting them, such as: labour, capital, land, and enterprise, inflation, economic growth, and public policies that impact these elements. It also seeks to analyse and describe the global economy. (Full article...)

Selected general articles

-

Image 1

Ragnar Anton Kittil Frisch (3 March 1895 – 31 January 1973) was an influential Norwegian economist and econometrician known for being one of the major contributors to establishing economics as a quantitative and statistically informed science in the early 20th century. He coined the term econometrics in 1926 for utilising statistical methods to describe economic systems, as well as the terms microeconomics and macroeconomics in 1933, for describing individual and aggregate economic systems, respectively. He was the first to develop a statistically informed model of business cycles in 1933. Later work on the model, together with Jan Tinbergen, won the first Nobel Memorial Prize in Economic Sciences in 1969.

Frisch became dr.philos. with a thesis on mathematics and statistics at the University of Oslo in 1926. After his doctoral thesis, he spent five years researching in the United States at the University of Minnesota and Yale University. After teaching briefly at Yale from 1930–31, he was offered a full professorship in economics, which he declined after pressures by colleagues to return to the University of Oslo. After returning to Oslo, Frisch was first appointed by the King-in-Council as Professor of Economics and Statistics at the Faculty of Law, University of Oslo (then the Royal Frederick University) in 1931, before becoming leader of the newly founded Institute of Economics at the University of Oslo in 1932. He remained at the University of Oslo until his retirement in 1965. (Full article...) -

Image 2

Production and national income: Macroeconomics takes a big-picture view of the entire economy, including examining the roles of, and relationships between, firms, households and governments, and the different types of markets, such as the financial market and the labour market.

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output/GDP (gross domestic product) and national income, unemployment (including unemployment rates), price indices and inflation, consumption, saving, investment, energy, international trade, and international finance.

Macroeconomics and microeconomics are the two most general fields in economics. The focus of macroeconomics is often on a country (or larger entities like the whole world) and how its markets interact to produce large-scale phenomena that economists refer to as aggregate variables. In microeconomics the focus of analysis is often a single market, such as whether changes in supply or demand are to blame for price increases in the oil and automotive sectors.

From introductory classes in "principles of economics" through doctoral studies, the macro/micro divide is institutionalized in the field of economics. Most economists identify as either macro- or micro-economists. (Full article...) -

Image 3Real business-cycle theory (RBC theory) is a class of new classical macroeconomics models in which business-cycle fluctuations are accounted for by real, in contrast to nominal, shocks. RBC theory sees business cycle fluctuations as the efficient response to exogenous changes in the real economic environment. That is, the level of national output necessarily maximizes expected utility.

In RBC models, business cycles are described as "real" because they reflect optimal adjustments by economic agents rather than failures of markets to clear. As a result, RBC theory suggests that governments should concentrate on long-term structural change rather than intervention through discretionary fiscal or monetary policy. These ideas are strongly associated with freshwater economics within the neoclassical economics tradition, particularly the Chicago School of Economics. (Full article...) -

Image 4The Lausanne School of economics, sometimes referred to as the Mathematical School, refers to the neoclassical economics school of thought surrounding Léon Walras and Vilfredo Pareto. It is named after the University of Lausanne, at which both Walras and Pareto held professorships. Polish economist Leon Winiarski is also said to have been a member of the Lausanne School. (Full article...)

-

Image 5

Elinor Claire "Lin" Ostrom (née Awan; August 7, 1933 – June 12, 2012) was an American political scientist and political economist whose work was associated with New Institutional Economics and the resurgence of political economy. In 2009, she was awarded the Nobel Memorial Prize in Economic Sciences for her "analysis of economic governance, especially the commons", which she shared with Oliver E. Williamson; she was the first woman to win the prize.

Trained in political science at UCLA, Ostrom was a faculty member at Indiana University Bloomington for 47 years. Beginning in the 1960s, Ostrom was involved in resource management policy and created a research center, the Workshop in Political Theory and Policy Analysis, which attracted scientists from different disciplines from around the world. Working and teaching at her center was created on the principle of a workshop, rather than a university with lectures and a strict hierarchy. Late in her career, she held an affiliation with Arizona State University. (Full article...) -

Image 6

Jan Tinbergen (/ˈtɪnbɜːrɡən/ TIN-bur-gən, Dutch: [jɑn ˈtɪmbɛrɣə(n)]; 12 April 1903 – 9 June 1994) was a Dutch economist who was awarded the first Nobel Memorial Prize in Economic Sciences in 1969, which he shared with Ragnar Frisch for having developed and applied dynamic models for the analysis of economic processes. He is widely considered to be one of the most influential economists of the 20th century and one of the founding fathers of econometrics.

His important contributions to econometrics include the development of the first macroeconometric models, the solution of the identification problem, and the understanding of dynamic models. Tinbergen was a founding trustee of Economists for Peace and Security. In 1945, he founded the Bureau for Economic Policy Analysis (CPB) and was the agency's first director. (Full article...) -

Image 7

The mythological Judgement of Paris required selecting from three incomparable alternatives (the goddesses shown).

Decision theory or the theory of rational choice is a branch of probability, economics, and analytic philosophy that uses expected utility and probability to model how individuals would behave rationally under uncertainty. It differs from the cognitive and behavioral sciences in that it is mainly prescriptive and concerned with identifying optimal decisions for a rational agent, rather than describing how people actually make decisions. Despite this, the field is important to the study of real human behavior by social scientists, as it lays the foundations to mathematically model and analyze individuals in fields such as sociology, economics, criminology, cognitive science, moral philosophy and political science. (Full article...) -

Image 8

Francis Ysidro Edgeworth FBA (8 February 1845 – 13 February 1926) was an Anglo-Irish philosopher and political economist who made significant contributions to the methods of statistics during the 1880s. From 1891 onward, he was appointed the founding editor of The Economic Journal. (Full article...) -

Image 9

Friedrich von Wieser (German: [fɔn ˈviːzɐ]; 10 July 1851 – 22 July 1926) was an early (so-called "first generation") economist of the Austrian School of economics. Born in Vienna, the son of Privy Councillor Leopold von Wieser, a high official in the war ministry, he first trained in sociology and law. In 1872, the year he took his degree, he encountered Austrian-school founder Carl Menger's Grundsätze and switched his interest to economic theory. Wieser held posts at the universities of Vienna and Prague until succeeding Menger in Vienna in 1903, where along with his brother-in-law Eugen von Böhm-Bawerk he shaped the next generation of Austrian economists including Ludwig von Mises, Friedrich Hayek and Joseph Schumpeter in the late 1890s and early 20th century. He was the Austrian Minister of Commerce from August 30, 1917, to November 11, 1918.

Wieser is renowned for two main works, Natural Value, which carefully details the alternative-cost doctrine and the theory of imputation; and his Social Economics (1914), an ambitious attempt to apply it to the real world. His explanation of marginal utility theory was decisive, at least terminologically. It was his term Grenznutzen (building on von Thünen's Grenzkosten) that developed into the standard term "marginal utility", not William Stanley Jevons's "final degree of utility" or Menger's "value". His use of the modifier "natural" indicates that he regarded value as a "natural category" that would pertain to any society, no matter what institutions of property had been established. (Full article...) -

Image 10

Thorstein Bunde Veblen (/ˈθɔːrstaɪn ˈvɛblən/; July 30, 1857 – August 3, 1929) was an American economist and sociologist who, during his lifetime, emerged as a well-known critic of capitalism.

In his best-known book, The Theory of the Leisure Class (1899), Veblen coined the concepts of conspicuous consumption and conspicuous leisure. Veblen laid the foundation for the perspective of institutional economics. Contemporary economists still theorize Veblen's distinction between "institutions" and "technology", known as the Veblenian dichotomy. (Full article...) -

Image 11

Wilhelm Röpke

Wilhelm Röpke (German: [ˈʁœpkə]; 10 October 1899 – 12 February 1966) was a German economist and social critic, one of the spiritual fathers of the social market economy. A professor of economics, first in Jena, then in Graz, Marburg, Istanbul, and finally Geneva, Röpke theorised and collaborated to organise the post-World War II economic re-awakening of the war-wrecked German economy, deploying a program referred to as ordoliberalism, a more conservative variant of German liberalism.

With Alfred Müller-Armack and Alexander Rüstow (sociological neoliberalism) and Walter Eucken and Franz Böhm (ordoliberalism) he elucidated the ideas, which then were introduced formally by Germany's post-World War II Minister for Economics Ludwig Erhard, operating under Konrad Adenauer's Chancellorship. Röpke and his colleagues' economic influence therefore is considered largely responsible for enabling Germany's post-World War II "economic miracle". Röpke was also a historian and was nominated to the Nobel Prize in Literature in 1965. (Full article...) -

Image 12Agent-based computational economics (ACE) is the area of computational economics that studies economic processes, including whole economies, as dynamic systems of interacting agents. As such, it falls in the paradigm of complex adaptive systems. In corresponding agent-based models, the "agents" are "computational objects modeled as interacting according to rules" over space and time, not real people. The rules are formulated to model behavior and social interactions based on incentives and information. Such rules could also be the result of optimization, realized through use of AI methods (such as Q-learning and other reinforcement learning techniques).

As part of non-equilibrium economics, the theoretical assumption of mathematical optimization by agents in equilibrium is replaced by the less restrictive postulate of agents with bounded rationality adapting to market forces. ACE models apply numerical methods of analysis to computer-based simulations of complex dynamic problems for which more conventional methods, such as theorem formulation, may not find ready use. Starting from initial conditions specified by the modeler, the computational economy evolves over time as its constituent agents repeatedly interact with each other, including learning from interactions. In these respects, ACE has been characterized as a bottom-up culture-dish approach to the study of economic systems. (Full article...) -

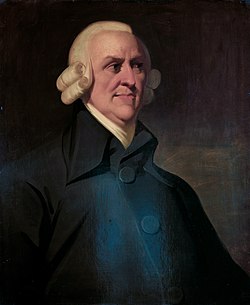

Image 13

Adam Smith (baptised 16 June [O.S. 5 June] 1723 – 17 July 1790) was a Scottish economist and philosopher who was a pioneer in the field of political economy and key figure during the Scottish Enlightenment. Seen by some as the "father of economics" or the "father of capitalism". He is known for two classic works: The Theory of Moral Sentiments (1759) and An Inquiry into the Nature and Causes of the Wealth of Nations (1776). The latter, often abbreviated as The Wealth of Nations, is regarded as his magnum opus, marking the inception of modern economic scholarship as a comprehensive system and an academic discipline. Smith refuses to explain the distribution of wealth and power in terms of divine will and instead appeals to natural, political, social, economic, legal, environmental and technological factors, as well as the interactions among them. The work is notable for its contribution to economic theory, particularly in its exposition of concept of absolute advantage.

Smith studied social philosophy at the University of Glasgow and at Balliol College, Oxford, where he was one of the first students to benefit from scholarships set up by John Snell. Following his graduation, he delivered a successful series of public lectures at the University of Edinburgh, that met with acclaim. This led to a collaboration with David Hume during the Scottish Enlightenment. Smith obtained a professorship at Glasgow, where he taught moral philosophy. During this period, he wrote and published The Theory of Moral Sentiments. Subsequently, he assumed a tutoring position that facilitated travel throughout Europe, where he encountered intellectual figures of his era. (Full article...) -

Image 14Neo-Marxism is a collection of Marxist schools of thought originating from 20th-century approaches to amend or extend Marxism and Marxist theory, typically by incorporating elements from other intellectual traditions such as critical theory, psychoanalysis, or existentialism. Neo-Marxism comes under the broader framework of the New Left. In a sociological sense, neo-Marxism adds Max Weber's broader understanding of social inequality, such as status and power, to Marxist philosophy.

As with many uses of the prefix neo-, some theorists and groups who are designated as neo-Marxists have attempted to supplement the perceived deficiencies of orthodox Marxism or dialectical materialism. Many prominent neo-Marxists, such as Herbert Marcuse and other members of the Frankfurt School, have historically been sociologists and psychologists. (Full article...) -

Image 15Thermoeconomics, also referred to as biophysical economics, is a school of heterodox economics that applies the laws of statistical mechanics to economic theory. Thermoeconomics can be thought of as the statistical physics of economic value and is a subfield of econophysics.

It is the study of the ways and means by which human societies procure and use energy and other biological and physical resources to produce, distribute, consume and exchange goods and services, while generating various types of waste and environmental impacts. Biophysical economics builds on both social sciences and natural sciences to overcome some of the most fundamental limitations and blind spots of conventional economics. It makes it possible to understand some key requirements and framework conditions for economic growth, as well as related constraints and boundaries. (Full article...) -

Image 16

Karl Gunnar Myrdal (/ˈmɜːrdɑːl, ˈmɪər-/ MUR-dahl, MEER-; Swedish: [ˈɡɵ̌nːar ˈmy̌ːɖɑːl]; 6 December 1898 – 17 May 1987) was a Swedish economist and sociologist. In 1974, he received the Nobel Memorial Prize in Economic Sciences along with Friedrich Hayek for "their pioneering work in the theory of money and economic fluctuations and for their penetrating analysis of the interdependence of economic, social and institutional phenomena." When his wife, Alva Myrdal, received the Nobel Peace Prize in 1982, they became the fourth ever married couple to have won Nobel Prizes, and the first and only to win independent of each other (versus a shared Nobel Prize by scientist spouses).

Myrdal is best known in the United States for his study of race relations, which culminated in his book An American Dilemma: The Negro Problem and Modern Democracy. The study was influential in the 1954 landmark U.S. Supreme Court decision Brown v. Board of Education. In Sweden, his work and political influence were important to the establishment of the Folkhemmet and the welfare state. (Full article...) -

Image 17New Institutional Economics (NIE) is an economic perspective that attempts to extend economics by focusing on the institutions (that is to say the social and legal norms and rules) that underlie economic activity and with analysis beyond earlier institutional economics and neoclassical economics.

The NIE assume that individuals are rational and that they seek to maximize their preferences, but that they also have cognitive limitations, lack complete information and have difficulties monitoring and enforcing agreements. As a result, institutions form in large part as an effective way to deal with transaction costs. (Full article...) -

Image 18The pluralism in economics movement is a campaign to change the teaching and research in economics towards more openness in its approaches, topics and standpoints it considers. The goal of the movement is to "reinvigorate the discipline ... [and bring] economics back into the service of society". Some have argued that economics had greater scientific pluralism in the past compared to the monist approach that is prevalent today. Pluralism encourages the inclusion of a wide variety of neoclassical and heterodox economic theories—including classical, Post-Keynesian, institutional, ecological, evolutionary, feminist, Marxist, and Austrian economics, stating that "each tradition of thought adds something unique and valuable to economic scholarship". (Full article...)

-

Image 19

Karl Marx (German: [ˈkaʁl ˈmaʁks]; 5 May 1818 – 14 March 1883) was a German philosopher, political theorist, economist, journalist, and revolutionary socialist. He is best-known for the 1848 pamphlet The Communist Manifesto (written with Friedrich Engels), and his three-volume Das Kapital (1867–1894), a critique of classical political economy which employs his theory of historical materialism in an analysis of capitalism, in the culmination of his life's work. Marx's ideas and their subsequent development, collectively known as Marxism, have had enormous influence.

Born in Trier in the Kingdom of Prussia, Marx studied at the universities of Bonn and Berlin, and received a doctorate in philosophy from the University of Jena in 1841. A Young Hegelian, he was influenced by the philosophy of Georg Wilhelm Friedrich Hegel, and both critiqued and developed Hegel's ideas in works such as The German Ideology (written 1846) and the Grundrisse (written 1857–1858). While in Paris, Marx wrote his Economic and Philosophic Manuscripts of 1844 and met Engels, who became his closest friend and collaborator. After moving to Brussels in 1845, they were active in the Communist League, and in 1848 they wrote The Communist Manifesto, which expresses Marx's ideas and lays out a programme for revolution. Marx was expelled from Belgium and Germany, and in 1849 moved to London, where he wrote The Eighteenth Brumaire of Louis Bonaparte (1852) and Das Kapital. From 1864, Marx was involved in the International Workingmen's Association (First International), in which he fought the influence of anarchists led by Mikhail Bakunin. In his Critique of the Gotha Programme (1875), Marx wrote on revolution, the state and the transition to communism. He died stateless in 1883 and was buried in Highgate Cemetery. (Full article...) -

Image 20

Georgist campaign button from the 1890s in which the cat on the badge refers to a slogan "Do you see the cat?" to draw analogy to the land question

Georgism, in modern times also called Geoism, and known historically as the single tax movement, is an economic ideology holding that people should own the value that they produce themselves, while the economic rent derived from land—including from all natural resources, the commons, and urban locations—should belong equally to all members of society. Developed from the writings of American economist and social reformer Henry George, the Georgist paradigm seeks solutions to social and ecological problems based on principles of land rights and public finance that attempt to integrate economic efficiency with social justice.

Georgism is concerned with the distribution of economic rent caused by land ownership, natural monopolies, pollution rights, and control of the commons, including title of ownership for natural resources and other contrived privileges (e.g., intellectual property). Any natural resource that is inherently limited in supply can generate economic rent, but the classical and most significant example of land monopoly involves the extraction of common ground rent from valuable urban locations. Georgists argue that taxing economic rent is efficient, fair, and equitable. The main Georgist policy recommendation is a tax assessed on land value, arguing that revenues from a land value tax (LVT) can be used to reduce or eliminate existing taxes (such as on income, trade, or purchases) that are unfair and inefficient. Some Georgists also advocate for the return of surplus public revenue to the people by means of a basic income or citizen's dividend. (Full article...) -

Image 21

Joseph Alois Schumpeter (German: [ˈʃʊmpeːtɐ]; February 8, 1883 – January 8, 1950) was an Austrian political economist. He served briefly as Finance Minister of Austria in 1919. In 1932, he emigrated to the United States to become a professor at Harvard University, where he remained until the end of his career, and in 1939 obtained American citizenship.

Schumpeter was one of the most influential economists of the early 20th century, and popularized creative destruction, a term coined by Werner Sombart. His magnum opus is considered Capitalism, Socialism and Democracy. (Full article...) -

Image 22Behavioral economics is the study of the psychological (e.g. cognitive, behavioral, affective, social) factors involved in the decisions of individuals or institutions, and how these decisions deviate from those implied by traditional economic theory.

Behavioral economics is primarily concerned with the bounds of rationality of economic agents. Behavioral models typically integrate insights from psychology, neuroscience and microeconomic theory. (Full article...) -

Image 23

Vilfredo Federico Damaso Pareto (/pəˈreɪtoʊ/; Italian: [paˈreːto]; born Wilfried Fritz Pareto; 15 July 1848 – 19 August 1923) was an Italian polymath, whose areas of interest included sociology, civil engineering, economics, political science, and philosophy. He made several important contributions to economics, particularly in the study of income distribution and in the analysis of individuals' choices, and was one of the minds behind the Lausanne School of economics. He was also responsible for popularising the use of the term elite in social analysis and contributed to elite theory. He has been described as "one of the last Renaissance scholars. Trained in physics and mathematics, he became a polymath whose genius radiated into nearly all other major fields of knowledge."

He introduced the concept of Pareto efficiency and helped develop the field of microeconomics. He was also the first to claim that income follows a Pareto distribution, which is a power law probability distribution. The Pareto principle was named after him, and it was built on his observations that 80% of the wealth in Italy belonged to about 20% of the population. He also contributed to the fields of mathematics and sociology. (Full article...) -

Image 24Malthus by John Linnell in 1834

Thomas Robert Malthus FRS (/ˈmælθəs/; 13/14 February 1766 – 29 December 1834) was an English economist, cleric, and scholar influential in the fields of political economy and demography.

In his 1798 book An Essay on the Principle of Population, Malthus observed that an increase in a nation's food production improved the well-being of the population, but the improvement was temporary because it led to population growth, which in turn restored the original per capita production level. In other words, humans had a propensity to use abundance for population growth rather than for maintaining a high standard of living, a view and stance that has become known as the "Malthusian trap" or the "Malthusian spectre". Populations had a tendency to grow until the lower class suffered hardship, want, and greater susceptibility to war, famine, and disease, a pessimistic view that is sometimes referred to as a Malthusian catastrophe. Malthus wrote in opposition to the popular view in 18th-century Europe that saw society as improving and in principle as perfectible. (Full article...) -

Image 25

Jean-Baptiste Say (French: [ʒɑ̃batist sɛ]; 5 January 1767 – 15 November 1832) was a liberal French economist and businessman who argued in favor of competition, free trade and lifting restraints on business. He is best known for Say's law—also known as the law of markets—which he popularized, although scholars disagree as to whether it was Say who first articulated the theory. Moreover, he was one of the first economists to study entrepreneurship and conceptualized entrepreneurs as organizers and leaders of the economy. He was also closely involved in the development of the École spéciale de commerce et d'industrie (ESCP), historically the first business school to be established. (Full article...)

Did you know...

- ... that Ruth Huenemann was one of the first researchers to make a connection between socioeconomic status and childhood obesity?

- ... that Elizabeth Wilkins chose to work at the Federal Trade Commission on the hope that the agency is now positioned to address economic injustice?

- ... that scientists from the Institutum Divi Thomae raised silkworms at Saint Gregory Seminary during World War II as a form of economic warfare against Japan?

- ... that the Canadian journalist Bernard Descôteaux is credited with the economic revival of the independent newspaper Le Devoir?

- ... that the 1983 Spanish floods were the most economically damaging in Spain until the 2024 Spanish floods?

- ... that a banker was named the prime minister of Equatorial Guinea after his predecessor resigned during an economic crisis?

Need help?

Do you have a question about Economics that you can't find the answer to?

Consider asking it at the Wikipedia reference desk.

Get involved

For editor resources and to collaborate with other editors on improving Wikipedia's Economics-related articles, see WikiProject Economics.

Selected images

-

Image 2An environmental scientist sampling water

-

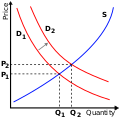

Image 4The supply and demand model describes how prices vary as a result of a balance between product availability and demand. The graph depicts an increase in demand from D1 to D2 and the resulting increase in price and quantity required to reach a new equilibrium point on the supply curve (S).

-

Image 6Economists study trade, production, and consumption decisions, including those that occur in a traditional marketplace

-

Image 8The Marxist critique of political economy comes from the work of German philosopher Karl Marx.

-

Image 10A 1638 painting of a French seaport during the heyday of mercantilism

-

Image 12Pollution can be a simple example of market failure; if costs of production are not borne by producers but are by the environment, accident victims or others, then prices are distorted.

-

Image 13The publication of Adam Smith's The Wealth of Nations in 1776 is considered to be the first formalisation of economic thought.

-

Image 14São Paulo Stock Exchange in Brazil, an electronic trading network that brings together buyers and sellers through an electronic trading platform

Subcategories

Subtopics

Associated Wikimedia

The following Wikimedia Foundation sister projects provide more on this subject:

-

Commons

Free media repository -

Wikibooks

Free textbooks and manuals -

Wikidata

Free knowledge base -

Wikinews

Free-content news -

Wikiquote

Collection of quotations -

Wikisource

Free-content library -

Wikiversity

Free learning tools -

Wiktionary

Dictionary and thesaurus

- Pages with Dutch IPA

- Pages with German IPA

- Pages with Swedish IPA

- Pages with Italian IPA

- Pages with French IPA

- Single-page portals

- Portals with no named maintainer

- Automated article-slideshow portals with article list built solely from one template

- Automated article-slideshow portals with 101–200 articles in article list

- Portals needing placement of incoming links